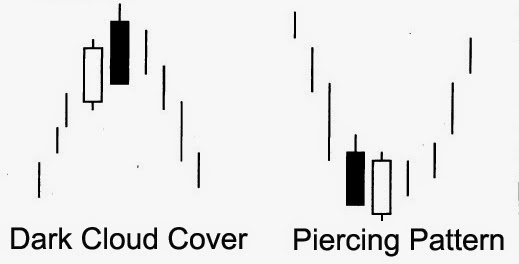

Dark Cloud Cover

A dark cloud shows, as the Japanese express it, that the market has a poor chance of rising. The dark cloud cover's first candle is a strong white session. During the next session, there is buying pressure left over and the market opens higher, but later in that session, prices decline as the market closes under the center of the previous session. This pattern reflects a period in the market when the upward power of the tall white candle has been dissipated by next session's weak black candle. In other words, the dark cloud cover displays pictorially a time in the market in which selling pressure is exceeding the buying pressure. A dark cloud cover often becomes resistance.

An ideal dark cloud cover's second session should close under the midpoint of the prior white candle. If the black candle does not close below the halfway point, it is considered by some japanese traders to be an incomplete dark cloud cover. In such cases, it is best to wait for confirmation during the next session in the form of a weaker close. As a general rule, the deeper the close of the dark cloud cover's second session pushes into the white candle, the more bearish the signal.

The Piercing Pattern

The piercing pattern is the opposite of the dark cloud cover. The dark cloud cover appears after an uptrend, and is comprised of a black real body that closes well into the prior white body. The piercing pattern is a white real body that closes within the prior black real body. This pattern shows that there is fierce buying at lower levels. The downward energy of the market has been dissipated.

What is important is the general concept that the more the white candle pierces the black candle, the more constructive the signal. If the white candle fails to move deeply into the black candle, it reflects a weak counterattack by the bulls and selling could resume.

It has been my experience that dark cloud covers are more prevalent than are piercing patterns. Part of the reason may have to do with an old Wall Street saying, "In on greed, out on fear." Although both greed and fear are strong emotions, I think many would agree that of the two, fear is the one that could cause the most volatile markets. During market bottoms, traders or investors usually have the opportunity to wait for an opportunity to enter the market. They may bide their time and wait for a pullback or for the market to build a base, or to see how the market reacts to news. Fear is more prevalent at tops. Fear is saying, "I want out-now!"

No comments:

Post a Comment